| IN A NUTSHELL |

|

Tesla, the pioneering electric vehicle manufacturer, is making significant strides in the energy sector with a new $4.3 billion deal with LG Energy Solution (LGES), a major South Korean battery manufacturer. This partnership focuses on the supply of lithium iron phosphate (LFP) batteries for stationary energy storage systems and not for electric vehicles. By producing these batteries in the United States, starting from August 2027 through July 2030, Tesla aims to enhance its Megapack systems. These large-scale battery installations are crucial for storing and distributing energy for grids and renewable energy facilities, marking a pivotal step in sustainable energy management.

Tesla’s Strategic Shift Toward Domestic Production

The recent agreement with LGES arrives only months after Tesla announced its inaugural overseas battery storage production plant in Shanghai, which is projected to deliver 10,000 Megapack units annually once operational. This new deal is a strategic move to strengthen the U.S. domestic supply chains, reducing Tesla’s dependence on Chinese suppliers like Contemporary Amperex Technology (CATL). By aligning with LGES, Tesla is also poised to navigate U.S. tariffs effectively and meet the Inflation Reduction Act (IRA) domestic content requirements for subsidies and incentives, thereby supporting the U.S.’s strategic focus on grid energy storage.

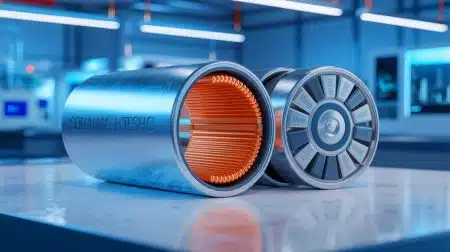

LFP batteries are renowned for their safety and stability, making them ideal for stationary storage solutions. LGES’s retooling of its Tennessee plant in collaboration with GM’s Ultium Cells to produce LFP cells underscores a long-term commitment to this battery chemistry. This partnership reflects a significant step forward in the energy storage landscape, paving the way for Tesla to enhance its role in the global clean energy market.

Domestic Supply Chain as a Competitive Advantage

As Tesla’s energy business, which includes products like the Megapack and Powerwall, experiences rapid growth, securing a large-volume domestic supply of LFP batteries becomes increasingly crucial. The record deployments in the second quarter of 2025 highlight Tesla’s expanded installation of Megapacks. However, despite these deployments, revenues have seen a slight dip, likely due to lower-priced or lower-margin products. This scenario underscores the necessity for Tesla to make energy storage more cost-efficient.

By securing a domestic battery supply, Tesla can better control costs, qualify for IRA credits, and ultimately improve profitability. The deal’s 7-year extension option further indicates the potential for continued collaboration with LGES through 2037, setting the stage for Tesla to potentially dominate the global grid battery market. This strategic pivot signifies Tesla’s broader ambition to transition from being merely an electric vehicle manufacturer to a key player in clean energy infrastructure.

Implications of the Tesla-LGES Partnership

This deal with LGES is more than just a business transaction; it represents a strategic pivot for Tesla into the realm of energy infrastructure. The Megapack systems, capable of storing excess renewable energy and dispatching it when needed, highlight Tesla’s commitment to decarbonization efforts. Each unit, weighing 38 tons and capable of storing over 3.9 megawatt-hours of energy, can power approximately 3,600 households for an hour, illustrating the potential impact on energy stability and sustainability.

By focusing on domestic production of LFP batteries, Tesla is reinforcing its commitment to sustainable energy solutions while simultaneously boosting the local economy. This strategic move not only positions Tesla as a leader in the energy storage sector but also aligns with global efforts to combat climate change through enhanced renewable energy solutions. As Tesla continues to innovate in this space, the broader implications for energy policy and market dynamics remain significant.

Future Prospects for Tesla’s Energy Vision

As Tesla expands its footprint in the energy sector, the implications of its partnership with LGES are profound. This move not only enhances Tesla’s strategic positioning but also reflects a broader industry shift towards sustainable energy solutions. The potential for extended collaboration through 2037 further solidifies Tesla’s role as a critical infrastructure provider in clean energy storage. As the world increasingly focuses on reducing carbon emissions, Tesla’s advancements in battery technology and energy storage solutions could play a pivotal role in shaping future energy policies.

As Tesla navigates these developments, one critical question remains: How will this strategic shift influence the global energy landscape, and what new innovations might emerge as Tesla continues to push the boundaries of sustainable energy solutions?

Did you like it? 4.5/5 (23)

Wow, $4.3 billion is a huge deal! Can’t wait to see the impact on the energy sector. 🔋💰

Will this partnership make Tesla batteries cheaper for consumers? 🤔

So Tesla is focusing more on energy storage than cars now? 🤯

Thank you for the insightful article! Always great to see Tesla leading the charge in clean energy. 🌱

Does this mean Tesla will rely less on Chinese battery suppliers?

Interesting! But when do we get our flying cars? 😂🛸

Great move by Tesla! Domestic production is key to sustainability. 🇺🇸